Tax Learning

Mengenal Pajak Bahan Bakar Kendaraan Bermotor (PBBKB) dalam UU HKPD

Tax Alert

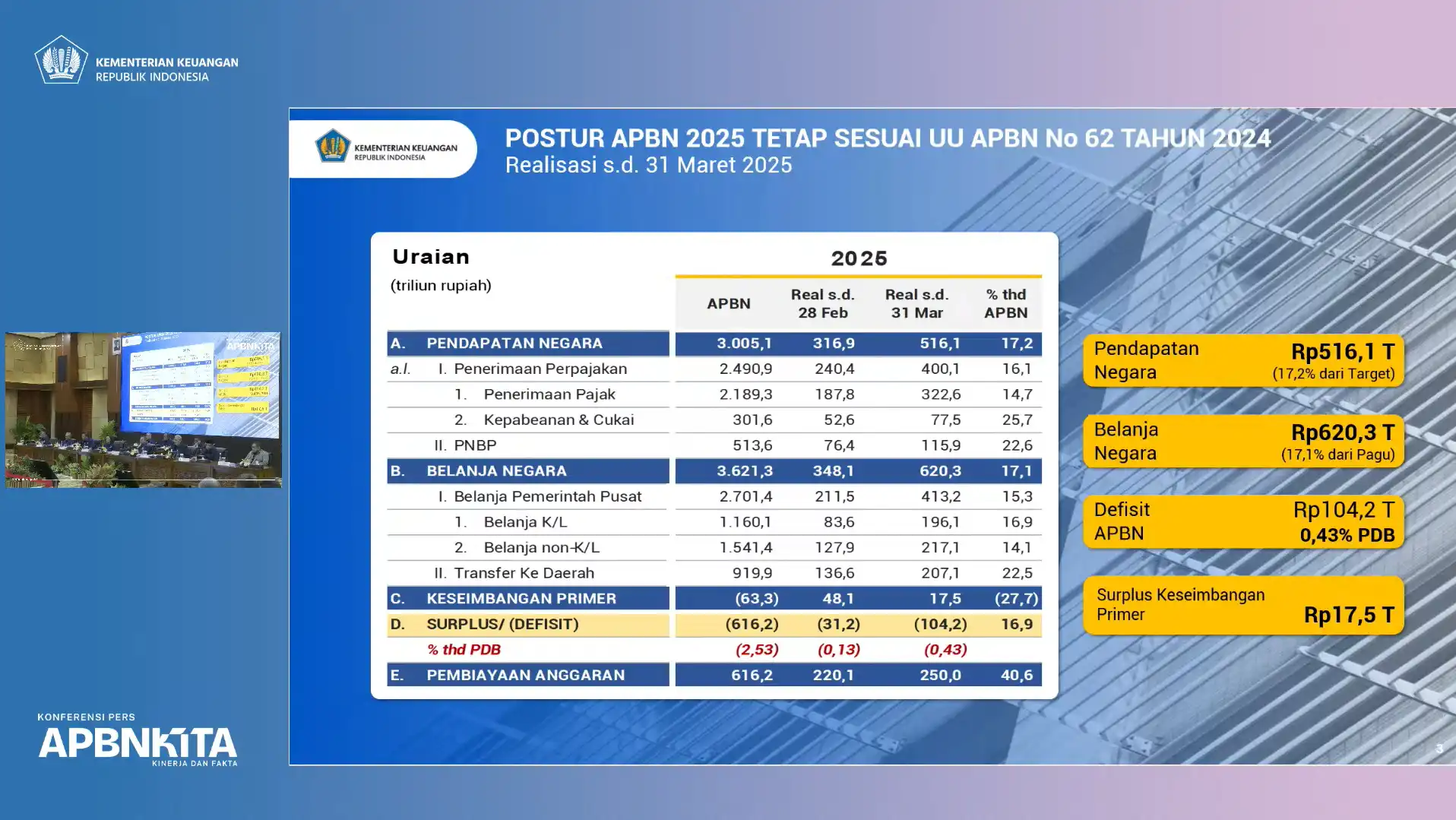

Batas Pelaporan Berakhir, DJP Catat Ada Penurunan Jumlah SPT Tahunan 2024

Tax Alert

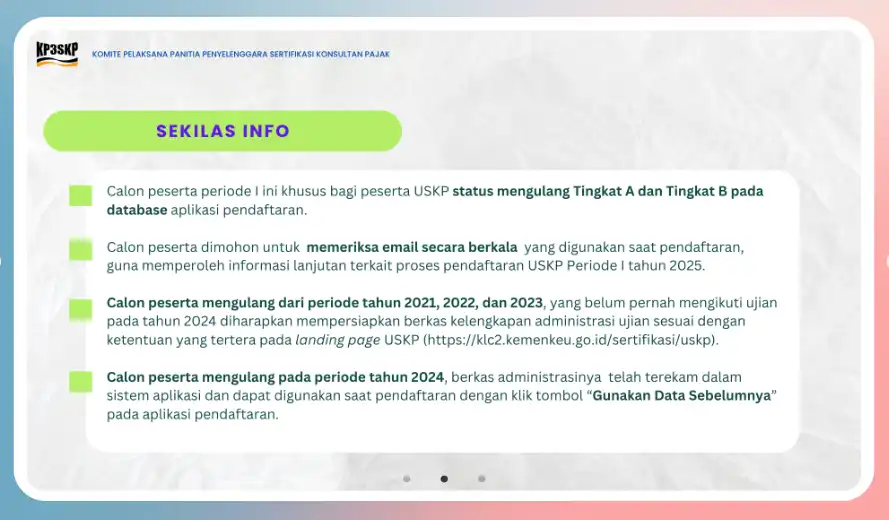

Panitia USKP Umumkan 1.979 Pendaftar Lulus Verifikasi

Memahami Konsep Earmarked Tax

Tax Learning17 April 2025

Bagaimana Pelaporan PPN KMS di Coretax?

Tax Learning15 April 2025

- More Highlights

Peraturan

View Allnilai kurs sebagai dasar pelunasan bea masuk, pajak pertambahan nilai barang dan jasa dan pajak penjualan atas barang mewah, bea keluar, dan pajak penghasilan yang berlaku untuk tanggal 7 mei 2025 sampai dengan 13 mei 2025

06 Mei 2025Lihat Peraturan

Tarif Bunga KMK

| Sanksi Administrasi | Tarif/bulan |

|---|---|

| Pasal 19 ayat (1), Pasal 19 ayat (2), dan Pasal 19 ayat (3) | 0,58% |

| Pasal 8 ayat (2), Pasal 8 ayat (2a), Pasal 9 ayat (2a), Pasal 9 ayat (2b), dan Pasal 14 ayat (3) | 1% |

| Pasal 8 ayat (5) | 1,42% |

| Pasal 13 ayat (2) dan Pasal 13 ayat (2a) | 1,83% |

| Pasal 13 ayat (3b) | 2,25% |

| Imbalan Bunga | Tarif/bulan |

|---|---|

| Pasal 11 ayat (3), Pasal 17B ayat (3), Pasal 17B ayat (4), dan Pasal 27B ayat (4) | 0,58% |

Resume | Katalog | Formulir

View AllKurs KMK

View All| Mata Uang | Nilai (Rp) |

|---|---|

| EURO | Rp18.951,10 |

| Dolar Amerika Serikat | Rp16.706,00 |

| Poundsterling Inggris | Rp22.294,49 |

| Dolar Australia | Rp10.702,72 |

| Dolar Singapura | Rp12.782,93 |

Kurs Bank Indonesia

View All| Mata Uang | Nilai (Rp) |

|---|---|

| EURO | Rp18.733,17 |

| Dolar Amerika Serikat | Rp16.579,49 |

| Poundsterling Inggris | Rp22.035,80 |

| Dolar Australia | Rp10.650,66 |

| Dolar Singapura | Rp12.802,69 |

.jpg)

.jpg)

Ketentuan Umum dan Tata Cara Perpajakan

Ketentuan Umum dan Tata Cara Perpajakan Pajak Penghasilan

Pajak Penghasilan Pajak Pertambahan Nilai

Pajak Pertambahan Nilai Pajak Bumi dan Bangunan (PBB)

Pajak Bumi dan Bangunan (PBB) Bea Perolehan Hak atas Tanah dan Bangunan (BPHTB)

Bea Perolehan Hak atas Tanah dan Bangunan (BPHTB) Bea Meterai

Bea Meterai Pengadilan Pajak

Pengadilan Pajak